Deciding to be a stay-at-home mom (or dad) is a HUGE decision.

Maybe you are the parent who always knew they wanted to stay home. Or, you might be the parent that said you would NEVER stay home.

Either way, there are a lot of factors to consider when making the decision for one parent to stay home with the kids.

Can you Afford to Live on One Income?

The biggest factor most families must consider is their financial situation.

Are you financially ready to be a stay at home parent? One way to find out is to try living off of one income. Automatically put one paycheck in savings for three months and consider how it affects your finances. Do you still have money left over at the end of the three months?

Do you need to cut spending in some areas?

Will you save any money by staying home? Will you spend more money by staying home?

I have listed out steps you can take to help you answer these questions below.

Figure Out Your Budget

I highly recommend signing up for a free account with Mint.com.

It is a great free and secure tool for budgeting, tracking and paying bills, and managing your money.

Mint allows you to enter your bills, credit and debit information, and create your own budget. It shows you easy to understand graphs of where your money is going.

You will also receive alerts you when you are getting close to going over budget in any one area. I suggest signing up for a free account to track your spending for these three months to see where you might be going over budget.

Next, make a list of expenses that you have because of work including daycare, work attire, gas for commuting to work, etc…I like to think of these extra work expenses as income when you stay at home. 🙂

Subtract these expenses from your budget and do a happy dance!

Of course, while you will be saving money in some areas, you may spend more in others because you stay home.

For example, you may not have to pay for lunch and snacks when your kids go to daycare.

However, when you stay home this is an added expense you will have to pay. Some daycare providers also pay for diapers and wipes so don’t forget to add those types of expenses as well.

What Can You Live Without?

Now, at this point you should have a general idea of how much much you will have left at the end of each month.

You may realize that you are way over budget and feel like staying home is not a possibility for you. However, if you really want to stay home, consider things that your family could possibly give up to save money.

For example, you may be able to cut cable and use Netflix instead.

Or, you might be able to get rid of your gym membership and work out at home.

If you are over budget, make a list of things that are not a necessity and subtract them from your budget.

Remember that this is potentially temporary and you may be able to add things back in slowly when you get a better feel for your budget.

Consider a Part Time Job

If you are still over budget after completing these steps, you might consider other ways to earn a small income on the side.

You may be able to find a job that you can do from home such as blogging or customer service.

Another option would be to find a part time job in the evenings or on the weekends.

This may not be ideal as you wouldn’t be together as a family as much. However, if you are absolutely set on making it work, you might consider this as a temporary solution.

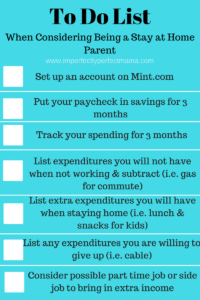

To Do Checklist

In order to help simplify the process, I have created a checklist of steps to take in order to decide if you are financially ready to live on one income.

I hope you can use this checklist in order to get a better idea if you are financially ready to live on one income.

What else is keeping you from being a stay at home parent? Leave a comment below and let me know!

Please pin this article if you found it helpful. Join me on Instagram and like my Facebook page to be a part of a wonderful community of new moms!

2 Comments